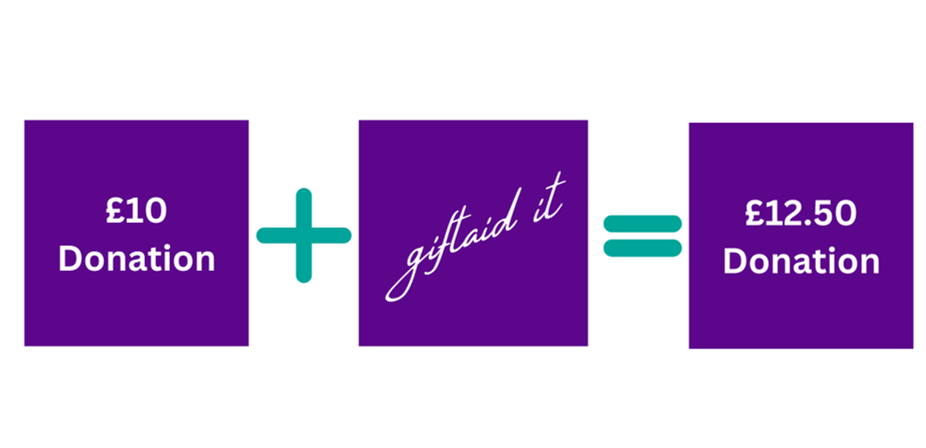

Help to make your donation worth 25% more in Gift Aid

What is Gift Aid?

Gift Aid is a government scheme which enables registered charities in the UK to claim the tax back from HMRC on the donations they receieve.

How it works

If you are currently a UK taxpayer and you fill out a Gift Aid declaration when you donate, we can claim back 25p for every £1 that you donate. Once signed, your Gift Aid declaration is valid for all your gifts in the future and for any gifts you have made in the last four years.

To declare all donations please contact us at pho-tr.

Declaration in detail

If you are a UK taxpayer and you would like Portsmouth Hospitals Charity to reclaim tax on the donations made in the last four years and any future giving you decide to take part in, you must first understand that if you pay less income or capital gains tax than the amount claimed on all donations in that tax year (April 6 – April 5) it is your responsibility to pay any difference.

Please note that Gift Aid cannot be claimed by one individual on monies collected from multiple donors. e.g. birthday collections.

Please notify Portsmouth Hospitals Charity if you want to cancel this declaration, change your name or full home address, no longer pay sufficient tax on your income or capital gains. If you are a higher rate taxpayer, you can claim personal tax relief via a self-assessment tax return or ask HM Revenue and customs to adjust your tax code.

You can make a declaration and join the scheme by post or by email. You will have 30 days to cancel, if necessary, before a claim is made. You can cancel at any time after that should your circumstances change.

You can read the HMRC's full guidelines here.